Iquality, Onfido and Ayvens Bank are joining forces

How do we build a bank that’s 100% online, but that feels like an in-person experience for our customers? That’s the question that Ayvens Bank, formerly known as LeasePlan Bank, has set out to answer. They’re a branchless bank, operating solely through their Ayvens Bank website and Savings app.

By reducing internal costs associated with branches , they can offer their customers attractive savings interest. As part of their approach, Ayvens Bank is pursuing the best-in-class in technology and UX. It’s a mission shared by Iquality and Onfido, specialist in identity verification. We’ve teamed up to power onboarding for Ayvens Bank’s online Savings experience.

The challenge of UX, compliance and technology

Founded in 2010, Ayvens Bank is building an online banking experience that competes with and exceeds the status quo set by branches. With their new approach to banking, Ayvens Bank has to balance needs from user experience, through to regulation, through to making it all technically possible.

Fundamentally, Ayvens Bank is measured on growth of their customer base. They need a seamless registration that can compete with emerging digital challenger banks, where ease of use is as important as interest rates. Equally, Ayvens Bank must remain compliant with local regulation. With AML and KYC coming under the microscope as financial services move online, the team knows they must onboard new users in a compliant way. Competing banks would routinely approach this with a journey to a physical bank branch. As a licensed entity under the European Central Bank, Ayvens Bank wants to let the right customers in remotely, going above and beyond today’s regulation.

So how does an emerging online bank tackle technology, regulation, and UX to cut through the market? That’s where Iquality and Onfido come in.

Joining forces with Onfido and Iquality has led to enormous improvements for Ayvens Bank.

Sander Frons, Director at Ayvens Bank

The collaboration with Onfido

Ayvens Bank turned to Onfido for their best-in-class online document verification, and to Iquality for our extensive expertise in engineering, UX and implementation within Ayvens Bank's architecture.

During the integration, Iquality and Onfido worked together to provide seamless customer onboarding. In just two months we achieved a successful and production-ready experience.

Promising results

For Ayvens Bank, their goal comes down to two things: creating an online compliant banking experience, while fuelling business growth.

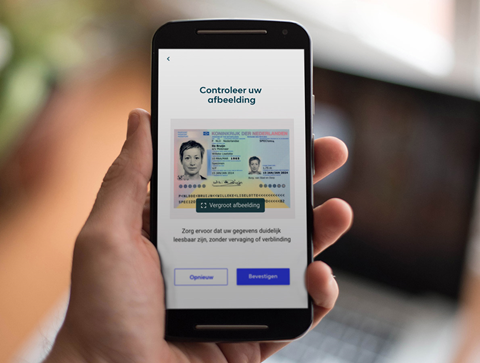

Our team built an experience that puts the customer in control. During onboarding, customers get a checklist of everything they need to create a savings account. For the Document Verification part, powered by Onfido, they simply take a photo of their ID using their smartphone.

Driven by a Document-first approach to verifying customer identities, Ayvens Bank is confident in their AML and KYC processes. Ayvens Bank is now automating over 50% of their onboarding process, translating to better interest rates for customers. Document-first onboarding also enables Ayvens Bank to better manage their own systems. Ayvens Bank can now also extract data from IDs and populate their internal banking records with cleaner, more accurate data.

All of this translates to a better customer experience. Ayvens Bank can now approve customers online with in-branch confidence in 6 minutes! In the future, Iquality and Onfido will continue working together to evolve Ayvens Bank’s onboarding to improve on UX and compliance.

Do you want to know what we can do for you?

Do you also want to significantly improve your customer onboarding? Don't hesitate to contact us. Together we'll look at which solution is suitable for you.